We deliver the best Merger or Acquisition opportunity that meets your specific company objectives

when Acquiring A Business

M&A : ADVISORY : IPO

Our Methodology

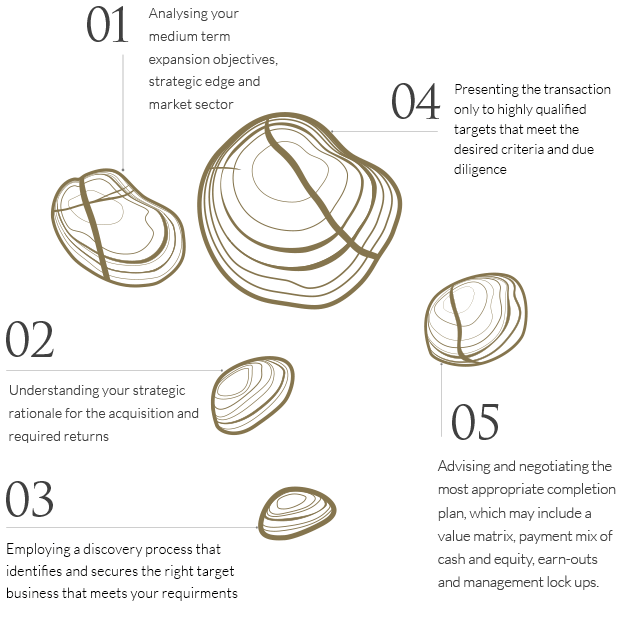

Our M&A model aims to deliver the best result, backed by a proven track record. our methodology is based on five cornerstones:

We will only introduce you to a business that ticks all your important boxes

M&A : ADVISORY : IPO

Our wealth of experience supports business acquisition through a

range of services, including expert research, insight and negotiation.

We work with a range of large corporate acquirers and high net

worth entrepreneurs, adding value via strategic acquisition services

that help buyers acquire a great business at a fair price.

CORPORATE ACQUIRERS

Having been a Corporate Acquirer ourselves, we have many years of experience in this area.

- We understand which boxes must be ticked for a Board to ultimately approve an acquisition

- We ensure a target business fits the strategic rationale of a corporate’s expansion strategy

- We find the perfect strategic bolt-on acquisition or merger opportunity

ENTREPRENEUR ACQUIRERS

- We work with self-made individuals looking to make their next business move. These

- entrepreneurs may have successfully exited one investment, and are now ready for a bigger

- and better acquisition – often via a business that fulfils a greater purpose or passion.

- Other high-net- worth entrepreneurs may have just arrived from Asia, Africa, Europe or the

- Americas, and are seeking an attractive mid-market acquisition with plenty of expansion opportunity, to utilise their considerable skills.

The Acquisition process

A merger or acquisition could take several forms, depending on resources and strategic intent. These may include one or more of the following:

- Outright purchase of the whole business or company shares, with no seller lock-up

- A staged purchase with lock-up and earn-out

- A merger with, or substantial stake in the target business, followed by a full purchase

- Leveraged buy-out (LBO), arranged with an optimum mix of senior and mezzanine lenders

- Creating a roll-up to list on the ASX via an Initial Public Offering (IPO) of merged entities.

M&A Middle Market Topics

Get in touch for a discreet information session about your exit, expansion or acquisition strategy where we will discuss the following 5 key items:

- Understand your desired outcome

- Understanding your business

- Develop a framework for your exit, expansion or acquisition strategy

- Advising the most appropriate and timeous way to be “Due Diligence” ready.

- How to present the transaction only to highly qualified suitors

Book your Strategy Session

Contact

Address:

Level 1,

121 Scarborough Street,

Southport,

4215

Telephone:

+07 5561 9008

Email:

[email protected]

© 2024 Wiese&Stone.